Slide title

Write your caption hereButton-

LET US SHOWER YOU

WITH LOAN SAVINGS1/2% OFF ALL LOANS

*Excludes Home Equities, Mortgages, Credit Cards, Line of Credits and Share CD/Share Secured Loans *APR = Annual Percentage Rate | Rate and term dependent on past credit performance | Rates and terms are subject to change.

Click to View Loan Rates -

$20,000 WELCOME HOME GRANT AVAILABLE

Contact one of our mortgage experts today!

Health Savings Accounts Now Available!

Learn More -

2024 SCHOLARSHIP AVAILABLE

TWO (2) $2,500 Scholarships Awarded

Entry deadline is April 26, 2024. Winners will be announced June 1, 2024

Learn More -

DO MORE THAN PROTECT YOUR HEALTH

GROW YOUR SAVINGS

Health Savings Accounts Now Available!

Learn More

MONEY MARKET ACCOUNTS

Coming Soon

High yield options that reward you with higher dividend rates for larger balances.It is the ideal account for

safeguarding larger deposits but being able to access in case of unexpected expense.

-

SHARED BRANCHING IS HERE

Shared branching allows access to 5,800 physical locations

across the country and abroad.AT ANY SHARED BRANCHING LOCATIONS | Get a copy of your account history | Make loan payments |

Transfer funds | Make deposits | Cash checks | And more!

Learn More

Slide title

Write your caption hereButton-

LET US SHOWER YOU WITH LOAN SAVINGS

1/2% OFF ALL LOANS

*Excludes Home Equities, Mortgages, Credit Cards, Line of Credits and Share CD/Share Secured Loans *APR = Annual Percentage Rate | Rate and term dependent on past credit performance | Rates and terms are subject to change.

Click to View Loan Rates -

2024 SCHOLARSHIP AVAILABLE

TWO (2) $2,500 Scholarships Awarded

Entry deadline is April 26, 2024. Winners will be announced June 1, 2024

Learn More -

DO MORE THAN PROTECT YOUR HEALTH

GROW YOUR SAVINGS

Health Savings Accounts Now Available!

Learn More

MONEY MARKET ACCOUNTS

Coming Soon

High yield options that reward you with higher dividend rates for larger balances.It is the ideal account for

safeguarding larger deposits but being able to access in case of unexpected expense.

-

SHARED BRANCHING IS HERE

Shared branching allows access to 5,800 physical locations

across the country and abroad.AT ANY SHARED BRANCHING LOCATIONS | Get a copy of your account history | Make loan payments |

Transfer funds | Make deposits | Cash checks | And more!

Learn More

Slide title

Write your caption hereButton-

LET US SHOWER YOU WITH LOAN SAVINGS

1/2% OFF ALL LOANS

*Excludes Home Equities, Mortgages, Credit Cards, Line of Credits and Share CD/Share Secured Loans *APR = Annual Percentage Rate | Rate and term dependent on past credit performance | Rates and terms are subject to change.

Click to View Loan Rates -

2024 SCHOLARSHIP AVAILABLE

TWO (2) $2,500 Scholarships Awarded

Entry deadline is April 26, 2024. Winners will be announced June 1, 2024

Learn More -

DO MORE THAN PROTECT YOUR HEALTH

GROW YOUR SAVINGS

Health Savings Accounts Now Available!

Learn More

MONEY MARKET ACCOUNTS

Coming Soon

High yield options that reward you with higher dividend rates for larger balances.It is the ideal account for

safeguarding larger deposits but being able to access in case of unexpected expense.

-

SHARED BRANCHING IS HERE

Shared branching allows access to 5,800 physical locations

across the country and abroad.AT ANY SHARED BRANCHING LOCATIONS | Get a copy of your account history | Make loan payments |

Transfer funds | Make deposits | Cash checks | And more!

Learn More

Online Loan Payments Secure

SERVING PEOPLE WHO

LIVE, WORK, WORSHIP, OR ATTEND SCHOOL IN MERCER COUNTY, OHIO

LENDING CENTER

MORTGAGE CENTER

STICK WITH WHO YOU KNOW AND TRUST TO HELP MAKE HOME OWNERSHIP A REALITY!

OUR MORTGAGE EXPERTS SIMPLIFY THE HOME BUYING PROCESS

Whether it's for your starter home or your dream home, a mortgage from Dynamic Federal Credit Union can make buying a breeze. Our loan advisors live right here in Mercer County, Ohio, so decisions are made locally by people you know and trust, not in a distant corporate office. Get help from financing experts you trust and see how easy buying a new home can be. Contact one of our knowledgeable mortgage lending officers to get started with the purchase of your new home or to refinance your existing mortgage.

KARA AUGUST

ANNETTE SAMANIEGO

ANNA MILLER

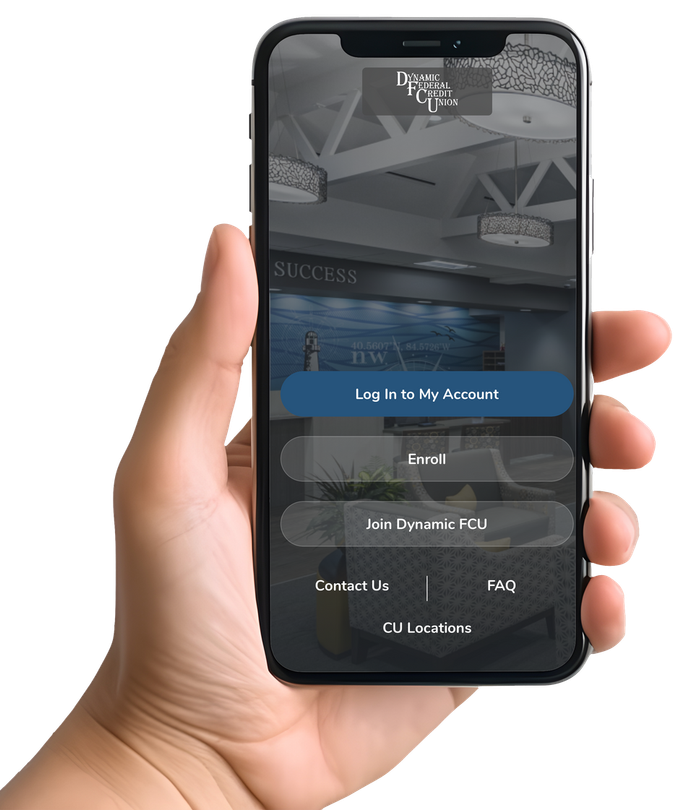

BANK ANYWHERE, ANYTIME WITH THE DYNAMIC FCU MOBILE APP!

Welcome to a new era of banking convenience! Introducing the Dynamic FCU Mobile App to take control of your finances effortlessly, wherever life takes you! Our app empowers you to access your accounts, make transactions, and simplify your financial journey. Join the future of banking – it's Dynamic, it's easy, and it's in the palm of your hand.

STAY IN THE KNOW WITH THE DYNAMIC NEWSLETTER!

Be a part of our thriving credit union community and elevate your financial journey with our e-newsletter. Each month we will feature financial insight, exclusive offers, community highlights and industry updates. Don't miss this chance to stay connected, informed, and empowered.

GUIDING THE WAY TO FINANCIAL SUCCESS

OFFICE INFORMATION

900 East Wayne St.

Celina, OH 45822

Routing Number: 242376411

NMLS ID: 665098

SITE MAP

QUICK LINKS

National Credit Union Administration, a U.S. Government Agency Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government