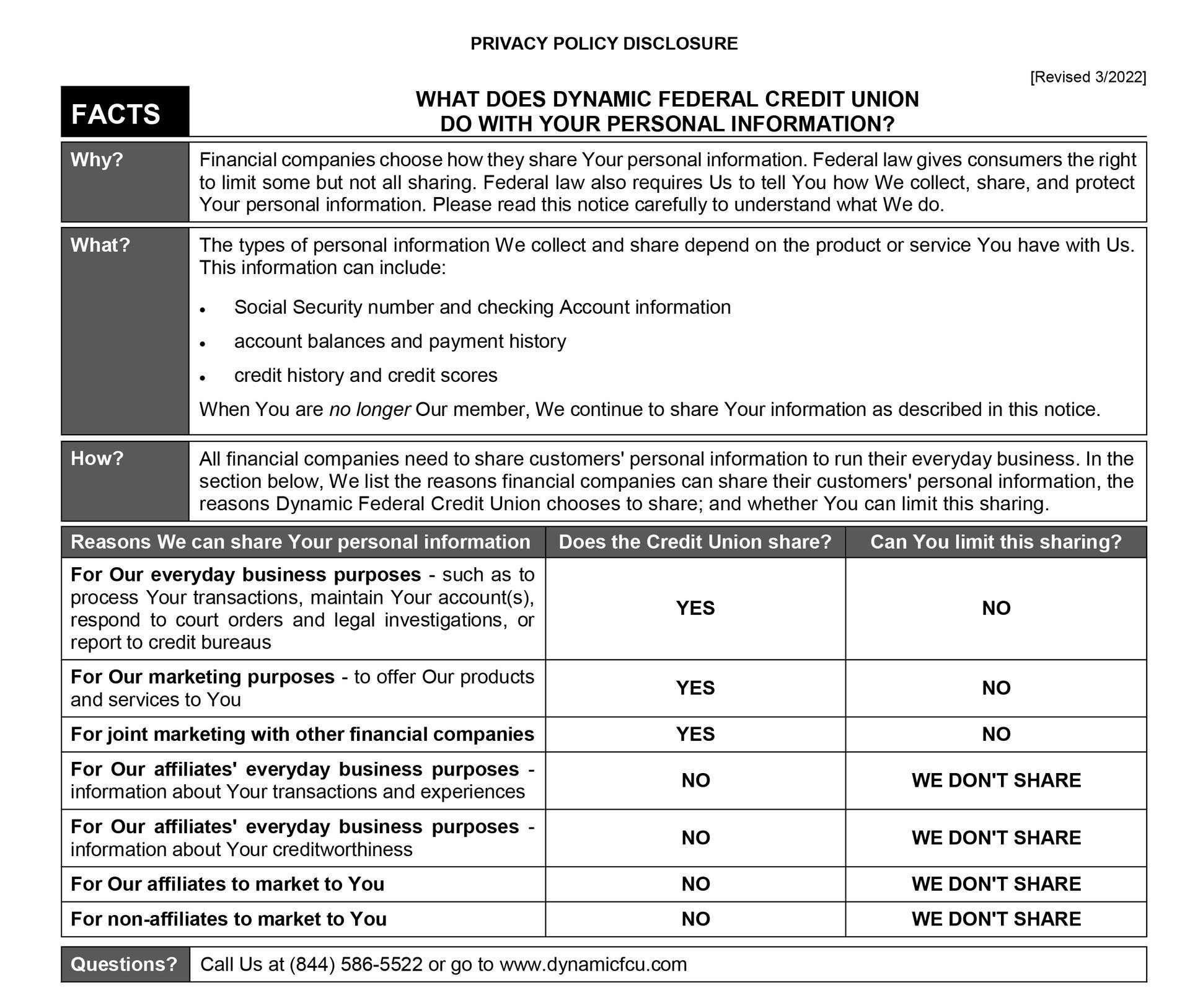

Protecting Your Information: The Dynamic FCU Privacy Commitment

Online & Digital Services Privacy Policy

Effective Date:

4/1/2025

1. Introduction

Dynamic Federal Credit Union ("Dynamic FCU," "we," "us," or "our") values your privacy and is committed to protecting the personal information of our members and users of our digital platforms, including our website (www.dynamicfcu.com), online banking platform (online.dynamicfederalcu.com), and mobile application (Dynamic FCU Mobile). This Privacy Policy outlines how we collect, use, share, and protect your personal information and explains your choices regarding your information.

2. Information We Collect

We collect various types of information when you use our website, online banking, and mobile application, including: We collect various types of information when you use our website, online banking, and mobile application, including:

- Personal Information: Name, address, email, phone number, Social Security Number, account details, and other identifiers.

- Device Information: IP address, browser type, operating system, device model, device geolocation, internet service provider, and mobile network information.

- Usage Information: Pages visited, features used, transaction history, and other interactions occurring on our digital platforms.

- Cookies and Tracking Technologies: We use cookies and similar tracking technologies to improve user experience and analyze website traffic. Some parts of our website may use cookies to store preferences and help us understand how our website is used. Users can configure their browser settings to refuse cookies if preferred.

- Online Account Opening: We utilize a third party to collect information for opening accounts. In addition to standard personal identifiable information, applicants will be required to upload a copy of their Photo ID and a Selfie to confirm identity.

- Online Loan Applications: We utilize a third party to collect information necessary for submitting loan applications online. In addition to standard personally identifiable information, applicants may be required to upload documentation such as proof of income, identification, and other supporting materials. This information is used to verify identity and evaluate loan eligibility, and it is securely transmitted and stored in compliance with applicable regulations.

- Membership Maintenance Requests: We utilize a third party to collect information necessary for submitting change requests related to your membership. This may include, but is not limited to:

- Updating your address, phone number, or email contact information.

- Changing your statement delivery preferences (e.g., switching between paper and eStatements).

- Modifying or canceling recurring or automated transfers.

- Requesting the addition or removal of joint account owners or beneficiaries.

- Updating your name due to legal changes (e.g., marriage or court order).

To process these changes, members may be required to provide documentation to verify identity and support the requested updates. All submitted information is handled securely and in compliance with applicable laws and regulations.

- Electronic Signatures: We may request and collect electronic signatures from members when submitting applications, agreements, or forms through our digital platforms. Electronic signatures are used to authorize transactions, consent to disclosures, and acknowledge receipt of important documents. By providing an electronic signature, you agree that it carries the same legal validity and enforceability as a handwritten signature under applicable laws. All electronically signed documents are securely transmitted and stored using encryption and access controls to protect your information. Your consent to use electronic signatures is obtained during the relevant process, and you may withdraw this consent at any time by contacting us, though doing so may limit access to certain digital services.

- Camera and Image Collection: Our banking app may collect and utilize user images for various purposes aimed at enhancing user experience and providing specific functionalities, such as uploading documents, identity verification, signature verification, and remote check deposit capture. Users maintain control over the camera access and usage within the app. Camera access is explicitly requested when the app requires image capture for any functionality. Users can enable or disable camera access at any time through the app's settings. Disabling camera access will prevent the app from utilizing the camera for any functionality requiring image capture. Any images collected are used solely for the intended purposes outlined above and are not shared with any unauthorized parties.

- Payment Information: We collect payment-related information, including account numbers, routing numbers, card numbers, expiration dates, and CVV codes, to facilitate transactions and provide secure banking services. This information is protected using industry-standard encryption and security measures to prevent unauthorized access or disclosure.

- Biometric Data: When you use features such as fingerprint or facial recognition to log into our mobile app, your biometric authentication remains on your device and is not collected or stored by Dynamic FCU. These features are optional and managed through your device settings. If enabled, biometric login provides a convenient and secure method for verifying your identity. Disabling biometric access on your device will prevent its use for authentication in our app.

For more information on how we share and protect this data, please refer to Section 4 – Information Sharing and Disclosure.

3. How We Use Your Information

We use the collected information for the following purposes:

- To provide and manage your account and transactions.

- To enhance security and prevent fraud.

- To improve our website, mobile app, and online banking services.

- To comply with legal and regulatory requirements.

- To send service updates, alerts, and marketing communications (with user consent where required).

- To analyze user interactions to enhance website performance and usability.

- To facilitate automated decision-making processes, such as credit approvals and fraud detection, where applicable.

4. Information Sharing and Disclosure

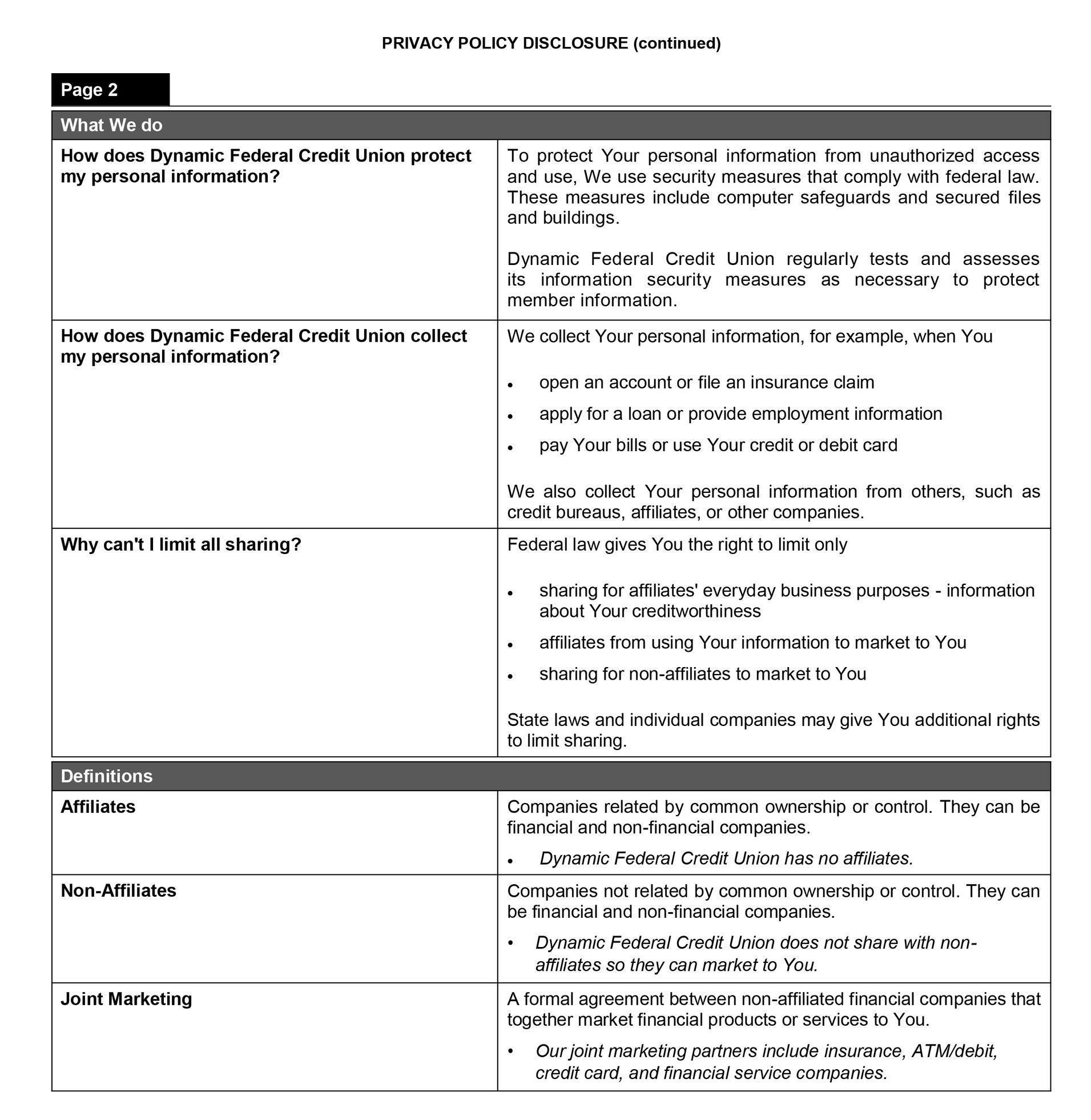

We do not sell, rent, or share your personal information with third parties for their marketing purposes. Users may opt-out of some data sharing with our third-party providers by contacting us through the contact details provided at the bottom of this policy. Certain financial and regulatory requirements as well as our ability to offer our services to you may require us to share your personal information. We may share information:

- With service providers and partners who assist in delivering our services, including data processors, technology providers, payment processors, fraud detection services, credit reporting agencies, and data analytics providers.

- When required by law, such as in response to legal requests or regulatory compliance.

- To protect the security of our systems, prevent fraud, or enforce our policies. We also maintain an incident response plan to promptly investigate and mitigate any potential breaches, as described in Section 5.

- With third-party vendors that support our mobile and online banking platforms, ensuring secure transactions and seamless functionality.

All service providers and partners are thoroughly vetted and held to security standards consistent with NCUA and applicable data privacy regulations. We ensure that all third parties with whom we share data maintain high standards of data protection and comply with applicable privacy regulations.

5. Data Security

Dynamic FCU continuously updates and improves security standards to prevent fraud and unauthorized access. We maintain physical, electronic, and procedural safeguards that comply with federal regulations. Our employees have an appropriate level of access to personal information to perform their duties. Additionally, we work with law enforcement officials to investigate unauthorized access attempts.

We also have an incident response plan in place to address potential data breaches. In the event of a security incident, we will promptly investigate, contain, and mitigate the impact. Where legally required, affected users will be notified and provided with relevant information on protective measures.

6. Data Retention and Access

We retain collected information for as long as necessary to fulfill the purposes outlined in this policy, comply with legal obligations, resolve disputes, and enforce agreements. Users may request access to, correction of, or deletion of their personal information by contacting us through the contact details provided at the bottom of this policy. Certain financial and regulatory requirements may mandate the retention of some data for a specified period.

Your Privacy Choices

You have control over your personal information, including:

- Updating your account details.

- Managing cookie preferences in your browser.

- Opting out of marketing communications.

- Restricting the use of certain data by adjusting settings in our mobile app.

7. Third-Party Services and External Links

Our digital platforms may contain links to third-party websites or integrate with third-party services. To promote transparency, when you click an external link, our digital platforms will notify you when you are leaving our website or mobile app. Users should be aware that clicking an external link will take them outside our site, and Dynamic FCU is not responsible for third-party privacy policies. We encourage reviewing their policies before providing personal information.

8. Mobile Banking & Mobile Website

For your convenience, Dynamic FCU offers mobile banking services. When you use our mobile app or mobile-optimized website, we may collect information such as unique device identifiers, IP Address data, geo location data, and biometric authentication preferences (e.g., fingerprint or facial recognition).

9. Text Message Communications

If you provide your mobile phone number to Dynamic FCU, you may receive text messages related to your account activity, transaction alerts, security notifications, service updates, and promotional content. These messages may be sent using automated technology. By providing your number, you consent to receiving such messages. You can opt out of marketing-related text messages at any time by following the instructions in the message (e.g., replying “STOP”) or by contacting us directly. However, you may still receive important account-related or security messages.

Please note that message and data rates may apply depending on your mobile carrier plan. We recommend users refrain from including sensitive or confidential information in text messages. For secure communications, please contact us to utilize encrypted or authenticated alternatives.

Users can manage text message preferences by contacting us directly or by adjusting notification settings within their online or mobile banking profiles.

10. Email Communications

If you choose to provide an email address, you consent to receiving communications from us, including direct communication from our staff, account notifications, security alerts, and promotional messages. Please note that transactional emails, such as those related to account updates, security alerts, and service notifications, are mandatory and will be sent even if you opt out of marketing emails. If you prefer not to receive marketing emails, you can opt out at any time. Since general email is not secure, we advise against sending us confidential information via email. The credit union has several options for securely sending confidential information. Contact us to learn about our secure messaging options, such as encrypted email or secure upload portals.

11. Compliance with NCUA, Google Play Store, and Apple App Store

This policy is designed to comply with:

- NCUA regulations regarding financial data protection and member privacy.

- Google Play Store and Apple App Store requirements for app privacy disclosures, including data collection, usage, and user control over personal information.

12. Notice Regarding Children’s Information

We respect the privacy of children and comply with the Children’s Online Privacy Protection Act. We do not knowingly collect personal information from children under

13. If we become aware of such information, we will take steps to delete it. All members under the age of

18 are required to have a parent or legal guardian added as a joint owner to all accounts. When using our online applications, such as: our scholarship and online account opening, all minors are required to have obtained the permission of their parent or legal guardian prior to applying. Dynamic Federal Credit Union will contact the parent or legal guardian before processing any applications.

13. Changes to This Privacy Policy

We may update this policy periodically. Changes will be posted on our website and app, with the updated effective date. Where required by law or deemed necessary, we will also notify users of significant changes via email, mail, or other direct communication channels. Continued use of our services after changes constitutes acceptance of the revised policy.

14. Contact Us & Accessibility

We are committed to ensuring our digital services are accessible to all users. If you have questions or concerns about this Privacy Policy or if you require this policy in an alternative format, please contact us.

Dynamic Federal Credit Union

900 East Wayne Street Celina Ohio

15. User Consent

By continuing to use our website, online banking, mobile app, or any of our digital services, you acknowledge that you have read and understood this Privacy Policy and consent to the collection and use of your information as described herein.